income tax calculator indonesia

Income Tax Rates and Thresholds Annual. However if your company is a public company that satisfy the minimum listing requirement of 40 in Indonesia Stock Exchange IDX and.

Indonesia Payroll And Tax Guide

This calculator uses IDR Indonesian Rupiah.

. Corporate Income Tax Rate. Annual Tax Exempt Income. A quick and efficient way to compare salaries in Indonesia review income tax deductions for income in Indonesia and estimate your tax returns for your Salary in Indonesia.

It can deal with activities made between the years 2000 to 2011. Except for self-assessed VAT on utilization of intangible taxable goods andor. Income tax in Indonesia can range from 5 to 30 percent and you need to be sure you are placed in the correct tax brackets.

Income Tax Calculator is a software designed to estimate federal taxes in the US that can be deducted from the users business. A tax resident is generally taxed on worldwide income although this may be mitigated by the application of double taxation agreements DTAs. The tax authorities have the right to audit any tax return to ensure the individual has correctly calculated the tax payable within the 5-year statute of limitations.

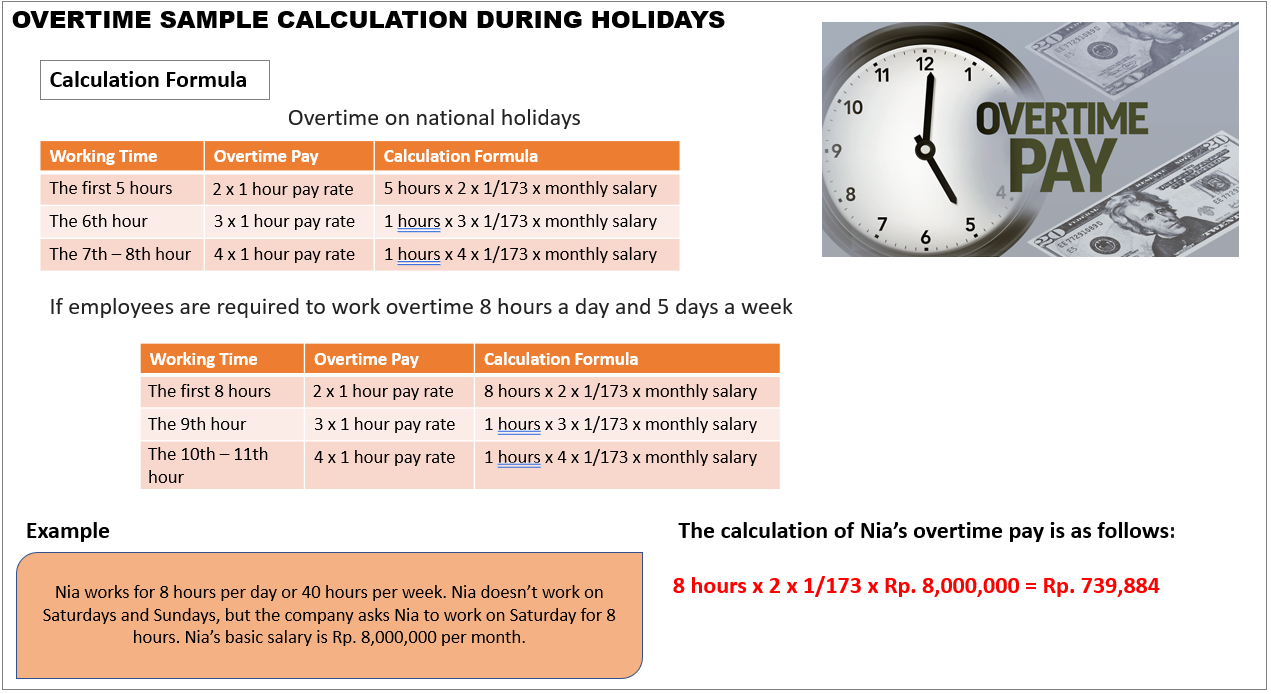

Taxpayers can extend the period of submission of the annual income tax return for 2 two months at the maximum by submitting notification to the ITA. TOTAL VALUE IN IDR Total Value in USD Total CIF x IDR exchange rate CIF Freight on Board Insurance Freight Cost x exchange rate. 4 rows Indonesia Residents Income Tax Tables in 2020.

Non-residents are subject to a 20 withholding tax on any income sourced within Indonesia. This includes corporate income tax personal income tax withholding taxes international tax agreements value-added tax VAT and many more. Such a payment is referred to as Article 29 income tax.

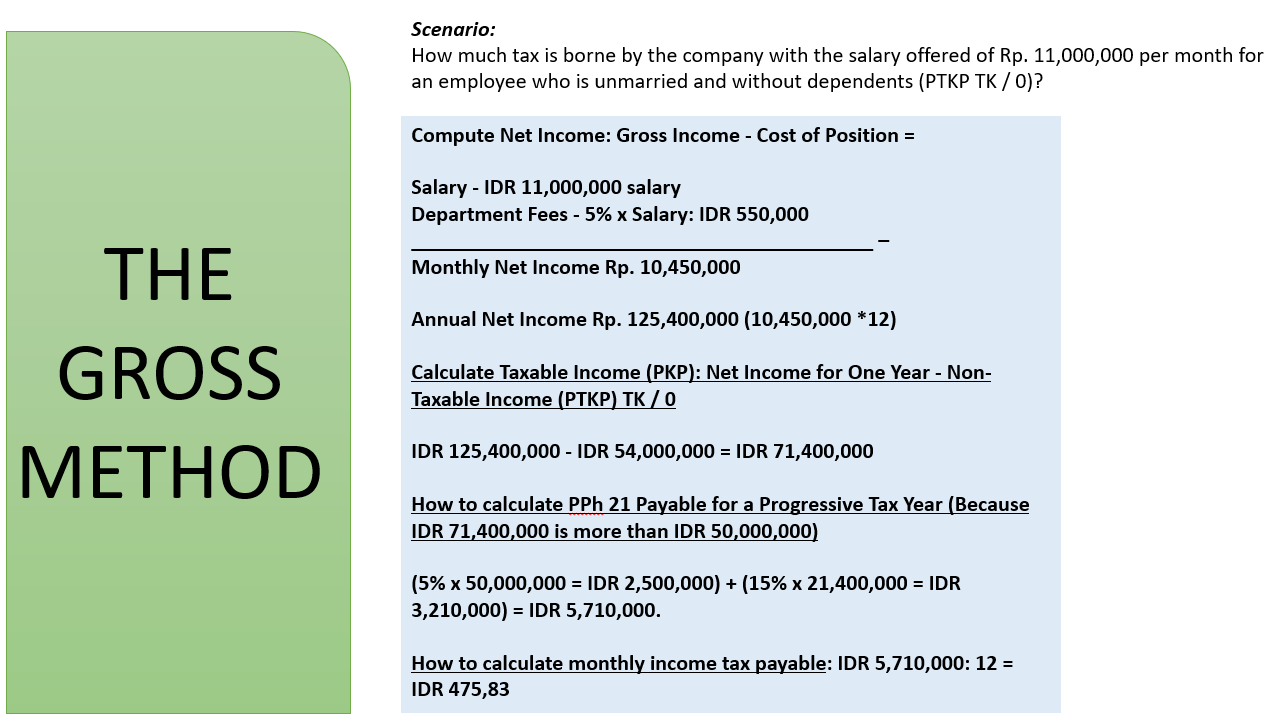

Non-taxable Incomes and Reliefs. As of 2016iii the non-taxable income threshold is IDR 54000000 per year for single individuals and IDR 58500000 per year for married individuals. The Indonesia Tax Calculator is a diverse tool and we may refer to it as the Indonesia wage calculator salary calculator or Indonesia salary after tax calculator it is however the same.

Total Annual Net Income. In Indonesia tax services are provided by Deloitte Touche Solutions. This is an income tax calculator for Indonesia.

To calculate the total import tax you will first need to convert the total value of the goods to Indonesian Rupiah using the following formula. This is an income tax calculator for Indonesia. Taxable income in Indonesia.

Resident taxpayers must file personal income tax returns through a self-assessment system and are subject to tax rates of 5 to 30. Point 13 multiplied by 12. 2 x 600000000 12000000 Personal allowances 54000000 3 x 4500000 67500000 Pension contribution.

In this respect the tax withheld by third parties referred to as Article 42 income tax constitutes the final settlement of the income tax for that particular income refer to pages. Bagi penerima penghasilan yang dipotong PPh Pasal 21 yang tidak memiliki NPWP dikenakan PPh Pasal 21 dengan tarif lebih tinggi 20 daripada tarif yang diterapkan terhadap wajib pajak yang. Deductions for an individual are Rp.

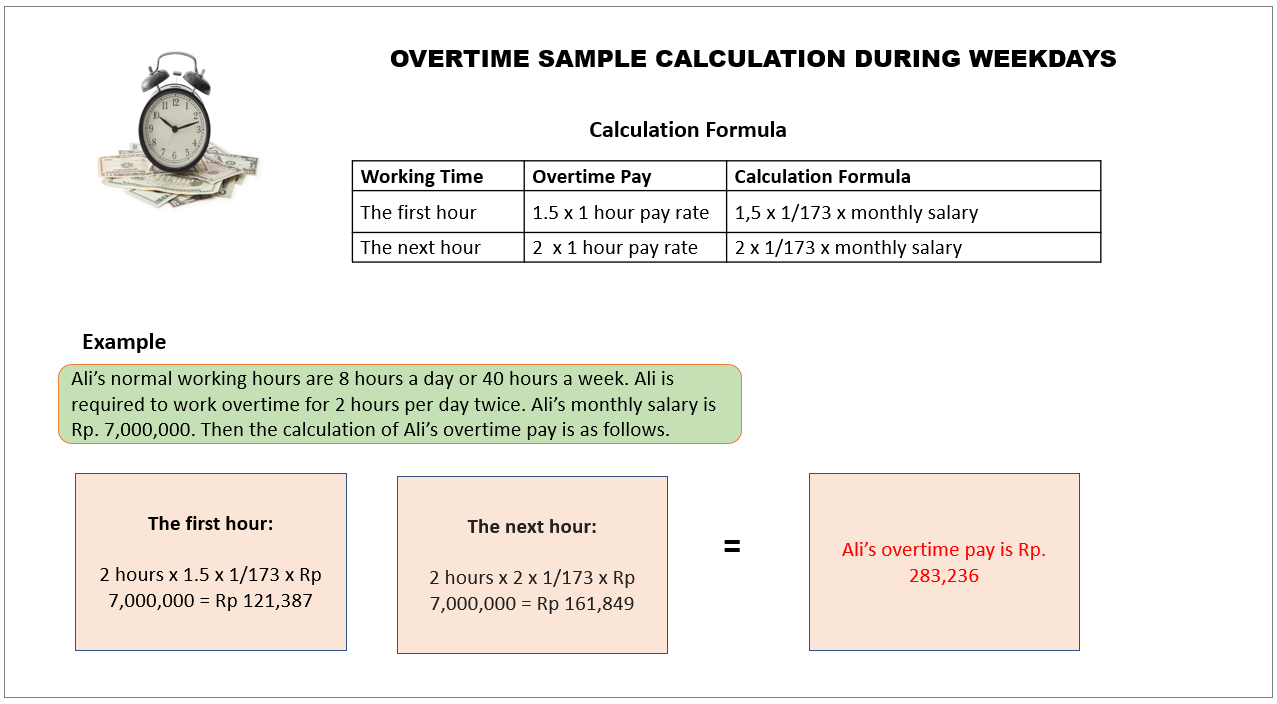

Calculate Employee Income Tax in Indonesia. How to calculate the total cost of import in Indonesia. Personal Income Tax Rate Rp An extra 20 is levied on people who do not have a tax number NPWP on top of progressive income tax rates above.

However the new Omnibus Law has added a provision to the Income Tax Law stipulating that foreigners who have become domestic tax. Indonesian residents qualify for personal tax relief as seen in the table below. In Indonesia a general flat rate of 25 applies becoming 22 in 2020.

The following tax rates can be used as your basic guidance to calculate how much income tax that you have to pay for. 2880000 wife 2880000 and up to three children Rp. The calculator only includes the individual tax-free allowance of IDR 24300000.

VAT on the export of taxable tangible and intangible goods as well as export of services is fixed at 0 percent. Indonesia - utilizes the self-assessment method for individuals to calculate settle and report income tax. Individual - Taxes on personal income.

Occupational expenses 5 from gross income or maximum 6000000 6000000 Old age saving contribution paid by employee. This amount needs to be calculated per salary. There is a wide variety of taxes in Indonesia that companies investors and individuals need to comply with.

Indonesian Tax Guide 2019-2020 9 3. You will be automatically redirected to the homepage in 30 seconds. However the exact rate may be increased or decreased to 15 percent or 5 percent according to government regulation.

Indonesia adopts a self-assessment system. Annual gross income. All companies doing business in Indonesia both locally owned and foreign owned are required to fulfill the corporate income tax obligations.

If you need to convert another. If you are S-0 for the tax year 2014 your tax exempt income becomes Rp 24300000 dan if you are M-2 in the year 2015 your tax exempt income becomes Rp 45000000. Indonesian tax resident and non-resident taxpayers who have Tax Identification Numbers Tax-ID are generally taxed on a.

Thus resident taxpayers have to calculate and settle ie if the Annual Individual Income Tax Return AIITR is showing underpayment amount and submit for the AIITR accordingly. Last reviewed - 30 December 2021. PPh 26 Income Tax is taxed at a flat rate of 20.

The personal income taxpayer can be a resident or a non-resident of Indonesia. Annual PPh 21 Tax. If you are a contractor and want a calculation on your tax and net retention in Indonesia we can supply it to you free of charge.

2 1 8939700 178794. Certain types of income earned by resident taxpayers or Indonesian PEs are subject to final income tax. Income Tax Calculator download in progress.

This field is adjusted toward your status Eg. Apakah Anda memiliki NPWP Bagian ini diisi dengan NPWP sesuai dengan yang tercantum pada Kartu Nomor Pokok Wajib Pajak Kartu NPWP. Generally the VAT rate is 10 percent in Indonesia.

The tax office requires all expatriates resident in Indonesia to register with the tax office and obtain their own separate tax number NPWP and pay monthly income taxes file.

How To Calculate Your 2013 Expatriate Individual Income Tax In China China Briefing News

Taxation System In Indonesia Your Guide To Income Taxation

Indonesia Payroll And Tax Guide

How To Calculate Income Tax In Excel

Calculating Individual Income Tax On Annual Bonus In China Updates Dezan Shira Associates

Personal Income Tax Calculator In Indonesia Free Cekindo

![]()

Indonesia Income Tax Calculator 2022 With Tax Brackets And Info Investomatica

Budget 2022 Income Tax Calculator Assumptions Kpmg Ireland

Indonesia Payroll And Tax Guide

How To Calculate Foreigner S Income Tax In China China Admissions

Indonesia Salary Calculator 2022 23

Indonesia Income Tax Calculator 2022 With Tax Brackets And Info Investomatica

Taxation System In Indonesia Your Guide To Income Taxation

Indonesia Payroll And Tax Guide

How To Calculate Income Tax In Excel

Singapore Income Tax Calculator Corporateguide Singapore

How To Calculate Income Tax In Excel

How To Calculate Foreigner S Income Tax In China China Admissions

Indonesia Vat Everything You Need To Know About Value Added Tax